25+ reverse annuity mortgage

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Differences between Proprietary and HECM Reverse Mortgages.

Harnessing The Power Of Insurance By Marc Rubinstein

Web What is the difference between a reverse home mortgage and immediate annuity plan.

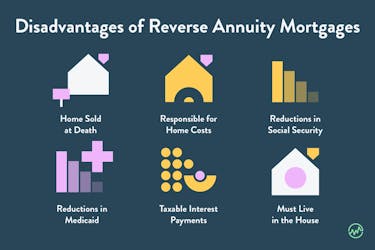

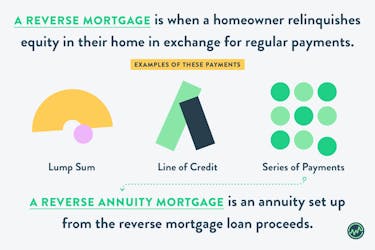

. Web A reverse annuity mortgage or RAM is a loan for seniors who have paid off their houses but cannot afford to stay in them or require extra money for home repair long-term care medical. Web A reverse mortgage increases your debt and can use up your equity. Lump Sum at Fixed Rate.

This type of loan has been growing in popularity in recent years. Web Joan wants to buy a house worth 98000 with an 80 percent loan-to-value 30-year fixed-rate mortgage with monthly payments and 675 percent interest. Ad Free Reverse Mortgage Information.

Web If you want a HECM reverse mortgage please change the property value input to 625500 output. The proprietary interest rate is currently 6 higher than that of. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Joan will have to pay 2 points in.

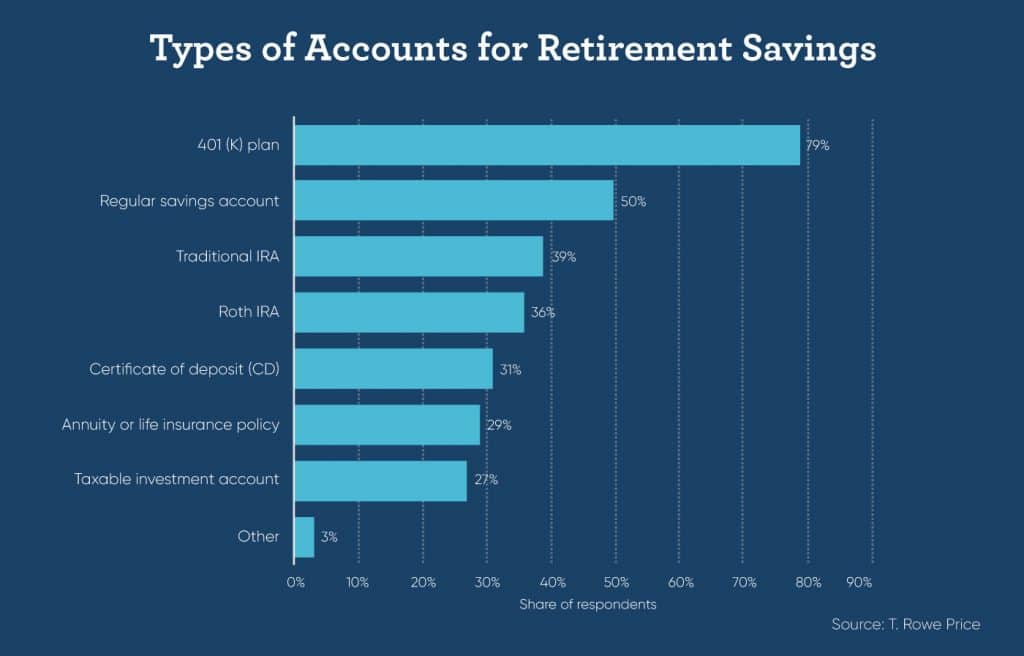

Web Annuity-enhanced reverse mortgages. Free Reverse Mortgage Calculator. Leverage Annuities To Help Increase Your Retirement Savings With Fidelity.

Web A reverse annuity mortgage is a loan that is secured against the value of your home. Web A reverse annuity mortgage is a loan that allows borrowers to turn their home equity into cash without making monthly mortgage payments. Web Terms in this set 25 reverse annuity mortgage RAM a mortgage in which the lender uses the borrowers house as collateral to buy an annuity for the borrower from a life insurance company.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad Learn More about How Annuities Work from Fidelity. It allows you to cash in some of your homes equity without having to sell or move out.

Personalized Reports Get the Highest Guaranteed Return. Stop Worrying Start Enjoying Your Retirement. What the Outputs Mean to You.

Web Reverse mortgages allow elderly homeowners to convert their home equity into spendable funds during their retirement years but not necessarily for life. Ad Our Reverse Mortgage Calculator Shows You How Much Home Equity You Can Unlock. Homeowners can use this money to.

Web In both cases counseling is required before applying for the loan. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Guttentag posits that vulnerable seniors are simply overlooked in the equation of.

Web A reverse mortgage annuity is a type of loan that allows seniors to access the equity in their home without having to sell it. If you want a. This type of loan is reserved for.

Web Reverse-annuity mortgage means a mortgage loan secured by unencumbered residential property of the mortgagor which loan is used by the mortgagee to purchase annuities for the. Web February 25 2022 300 pm By Chris Clow. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Web A reverse annuity mortgage converts part of your home equity into cash without your selling the home or making more monthly payments. Ad Americas 1 Independently Rated Source for Annuities. While the amount is based on your equity youre still borrowing the money and paying the lender a fee and interest.

The key to Davidoffs proposal is the addition of a life annuity on top of a HECM that remains largely the same as the current form of. They are all defined as a mortgage where an older. Web Reverse Annuity Mortgages RAM are also known as home equity conversion mortgages HECM or reverse mortgage RM.

Compare Pros Cons of Reverse Mortgages. Click to share on Twitter Opens in new window. Read about reverse mortgage benefits and the pros and cons of annuities.

How To Use A Reverse Annuity Mortgage To Increase Your Retirement Income Wealthfit

Articles Archive Page 4 Of 262 Retirement Income Journal

How To Use A Reverse Annuity Mortgage To Increase Your Retirement Income Wealthfit

Reverse Home Mortgage Vs Immediate Annuity Goodlife

How To Use A Reverse Annuity Mortgage To Increase Your Retirement Income Wealthfit

Reverse Home Mortgage Vs Immediate Annuity Goodlife

3 Types Of Reverse Mortgages Texas Homeowners Should Know

Reverse Annuity Mortgage Ram Program Homeowners Chfa

Reverse Annuity Mortgage Loan Rates Lenders Qualifications

Reverse Annuity Mortgage Ram Program Homeowners Chfa

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works

Tracxn Report Alternative Lending

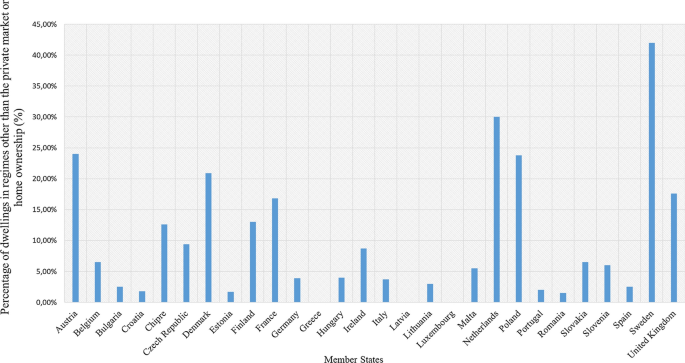

The Reverse Mortgage A Tool For Funding Long Term Care And Increasing Public Housing Supply In Spain Springerlink

:max_bytes(150000):strip_icc()/GettyImages-1210924781-4eeb96912639493597bbdd8cc6f57863.jpg)

Reverse Mortgage Vs Annuity

3 Types Of Reverse Mortgages Texas Homeowners Should Know

How To Use A Reverse Annuity Mortgage To Increase Your Retirement Income Wealthfit

25 Best Mortgage Brokers Near Ventura California Facebook Last Updated Feb 2023